Last month, the San Jose City Council voted to place a quarter-cent sales tax on the June 2016 ballot. The increase would yield a projected $40 million in annual revenue to support police, fire and emergency response, parks, economic development and other basic government services. SPUR endorses the sales tax and urges voters to pass it. For the past nine months, we have been involved in analyzing the City of San Jose’s fiscal condition (a joint project with Working Partnerships USA). Our findings — which we will publish next month —reveal that passing a local sales tax is one of best ways the city can restore needed services that were cut during the recession.

How would the tax work and where would the revenue go?

Measure B would enact a 0.25 percent local sales tax, increasing San Jose’s sales tax from 8.75 percent to 9 percent for 15 years. This is a general tax, meaning all revenues generated would go into the city’s General Fund and could be used for any purpose.

The ballot language refers to specific services such as “improving police response to reduce violent crimes and burglaries; improving 911/emergency medical/fire response times; repairing potholes and streets; maintaining parks; expanding gang prevention; and maintaining the city's long-term financial stability.” Because it’s a general tax, the city would not be legally bound to fund those specific uses with the proceeds of this tax. However, there would be a citizen oversight committee and an audit of where the proceeds would be spent.

As a general tax, Measure B requires a simple majority of 50-plus percent to pass. (In contrast, special taxes that dedicate funds for a specific purpose, such as public safety, require a two-thirds vote to pass).

Why does San Jose need to raise its sales tax?

There are four key reasons why this measure is on the ballot now:

1. San Jose continues to face major fiscal strain and needs additional revenue to restore services.

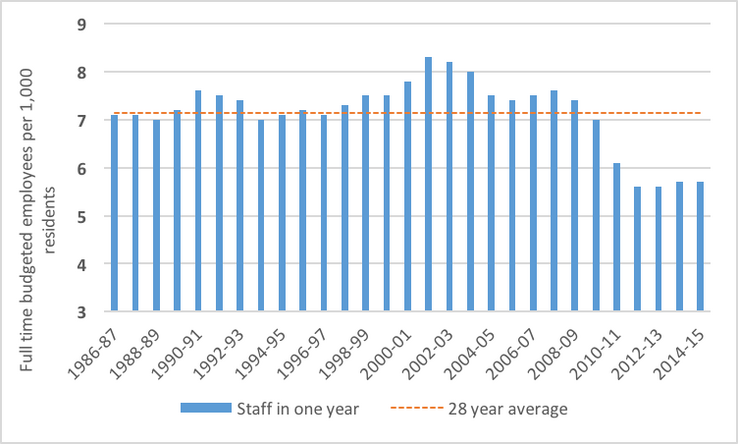

San Jose has suffered more than a decade of major budget deficits after two economic events: the dot-com bust in 2001 and the Great Recession from 2007 to 2009. The city’s fiscal strain was further increased by rising pension costs and other retirement benefit enhancements enacted during the dot-com boom. In response to this major fiscal strain, the city reduced its staffing by more than 1,600 positions, cut salaries by 10 percent, reduced services across many departments and withheld funding for ongoing infrastructure maintenance, leading to an annual infrastructure deficit of $175 million with $1 billion in deferred maintenance. The city continues to maintain a lower level of services than it would like, with fewer public safety officers per capita than its peers, slower police response times, declining road maintenance conditions and a continued skeleton staffing structure. San Jose has only 5.7 city staff per 1,000 residents, compared with 7.7 in San Diego, 8.7 in Sacramento, 9.2 in Los Angeles and 9.8 in Oakland.

San Jose City Staff per 1,000 Residents

After 2009, San Jose reduced staff by 1,600 positions and now maintains far fewer staff relative to its population than other large cities in California.

2. San Jose has talked about raising the sales tax for eight years, but a window of opportunity has only opened recently.

During its period of greatest fiscal strain, San Jose produced two major reports on the city’s condition: a Structural Deficit Elimination Plan in 2008 and a Fiscal Reform Plan in 2011. Those reports proposed that the city pursue new revenues, including passage of a local sales tax. In the ensuing years, local polling data demonstrated that there was not sufficient support to place a sales tax on the local ballot (although the city administration recommended placing a sales tax on the ballot in August 2012 and August 2014). In 2016 new polling suggests voter support is far higher than in prior years, as detailed in a recent city memo (see Attachment A).

3. San Jose is last among the larger cities in Santa Clara County in per capita sales tax receipts.

For a variety of reasons, San Jose receives far less revenue than its neighbors per capita from sales taxes. Much of this has to do with retail purchasing patterns and “sales tax leakage,” where residents purchase taxable goods outside of the city they live in.

Attracting more retail stores to San Jose is one way to increase sales tax per capita (and it’s part of the city’s long-term economic development strategy). But a faster and more direct way is to slightly increase the local sales tax. An increase should be small enough that it doesn’t encourage people to leave their city to shop but large enough to bring in sufficient revenue. Measure B meets that standard.

Per Capita Annual Sales Tax Revenue in Santa Clara County’s Largest Cities

San Jose ranks last among the large cities in Santa Clara County in per capita local revenue from sales tax, based on an analysis of the average annual receipts between 2003 and 2014.

Source: SPUR analysis of California Controller’s Cities Financial Reports 2003 through 2014. Available at: https://bythenumbers.sco.ca.gov/finance-explorer/view-by-city

4. If San Jose doesn’t raise its sales tax now, it may lose the opportunity as the county nears its sales tax cap.

Under state law, the base sales tax is 7.5 percent, with 1 percent going to the local government and the remaining 6.5 percent going to the state. Also under state law, any jurisdiction can only raise local sales taxes up to 2 percent more than the state base (i.e., up to 9.5 percent). In addition to the 7.5 percent base, Santa Clara County has already adopted a series of local sales tax increases totaling 1.25 percent (most of which go to fund the Santa Clara Valley Transportation Authority, as well as to bring BART to Silicon Valley). This leaves only 0.75 percent additional sales tax that can be raised in San Jose before it reaches the state’s cap.

It’s expected that the VTA will place a half-cent sales tax for transportation on this year’s November ballot. If San Jose does not adopt the sales tax increase in June, it’s possible that the county will pursue the remaining quarter cent in a future election, preventing San Jose from adopting any local sales tax.

While Santa Clara County has frequently pursued sales taxes to fund county priorities, the only city in the county with a local sales tax is Campbell. (San Jose will become the second if Measure B passes.) Should San Jose not adopt the sales tax in June, it may miss the window to approve a local sales tax within the legal limit.

Are there downsides to a sales tax increase?

Sales taxes are often considered more regressive than other taxes on individuals, meaning they have a bigger impact on lower-income people and households. (Those with low incomes spend a larger portion of their earnings on consumer goods, so the taxes they pay are a higher portion of their income.) However, the regressive tendencies of this sales tax are offset by other factors. Some low-income residents may benefit more from government programs funded by the tax, meaning their payments would be offset by government services they receive. In addition, many household goods would be exempt from the sales tax, including groceries, housing, medical care and some transportation expenditures.

The upshot: San Jose voters should adopt the sales tax in June

San Jose’s budget has suffered major cuts, and the city has already restructured many services. Even during the current economic boom, revenues remain just barely above expenditures — even though the city is operating with fewer staff and reduced service levels. San Jose is also projecting a budget shortfall for the next four years, starting next year. If the city does not pursue a sales tax in 2016, it may miss the opportunity. We believe the proposed increase is a reasonable part of a balanced solution to the ongoing structural budget challenge facing San Jose. A general purpose sales tax spreads the burden between business, consumers and those who pay fees for government services. SPUR recommends that San Jose voters support the Measure B on the June ballot.