SF

Prop

L

Transportation Tax

Sales Tax for Transportation Projects

Continues the existing half-cent sales tax to fund transportation improvements without increasing the current tax rate.

Vote YES

Continues the existing half-cent sales tax to fund transportation improvements without increasing the current tax rate.

Note: SPUR is a co-sponsor of Prop. L.

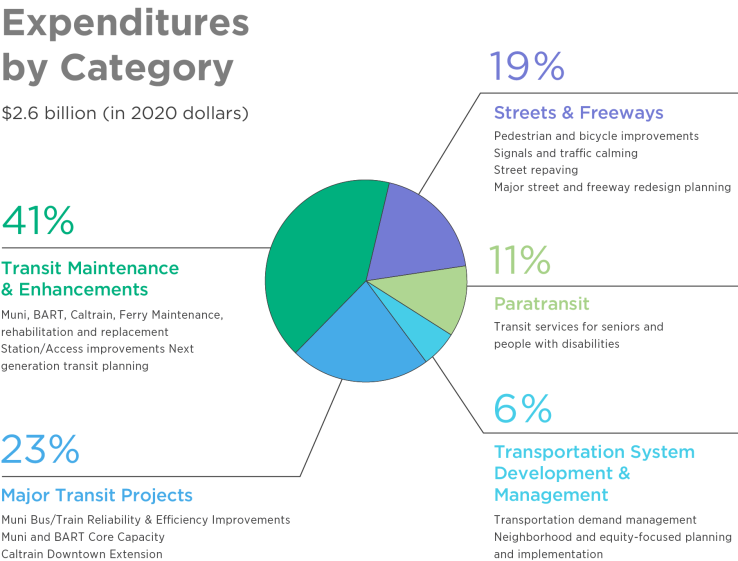

Proposition L would extend the existing half-cent sales tax for transportation for 30 years and approve a new 2022 Transportation Expenditure Plan for transportation projects and programs. The measure[1] and Expenditure Plan would include funding for:

In 2003, San Francisco voters approved Prop. K, a half-cent sales tax for transportation and a Transportation Expenditure Plan to guide how Prop. K revenues were spent. Prop. K has generated about $100 million annually for transportation improvements. The San Francisco County Transportation Authority, which administers the half-cent sales tax program, has sponsored Prop. L to continue the tax, approve a new 30-year investment plan and generate a local match to compete for additional federal funding. Federal government grants for capital projects require local funding contributions. The transportation authority estimates that every dollar of sales tax invested in San Francisco leverages four to seven times that amount in federal, state and other funds.

The half-cent sales tax has funded critical investments — including the purchase of new light-rail vehicles and Muni buses, BART station improvements, paratransit services, the Better Market Street project, Caltrain maintenance and neighborhood improvements such as crosswalks, sidewalk repairs and bicycle safety projects — especially in equity priority communities and other underserved neighborhoods. All but one of the projects funded in the 2003 expenditure plan have been completed or are underway, and some city-run programs will need new funding to continue. Through extensive stakeholder engagement, the City of San Francisco has identified new transportation priorities, which this measure would fund.

Prop. L was put onto the ballot by a unanimous vote of the Board of Supervisors and requires approval by a two-thirds majority of voters to pass.

Local funding sources like sales taxes are a crucial funding source for local governments, which have few tools for raising revenue needed to pay for public goods. Nonetheless, sales taxes are a regressive funding source. An advisory committee for the measure has recommended an expenditure plan that would help advance equity and mitigate the regressiveness of the tax, particularly by investing most of the revenue in transit, which would disproportionately benefit low-income San Franciscans.

Prop. L would increase the funding for paratransit and street safety projects, many of which are located in equity priority communities. The San Francisco County Transportation Authority also has implemented several policies to address equity:

SPUR supports taxation for the public good and believes that this measure balances concerns about the regressive revenue source with essential maintenance and improvements to meet the mobility needs of all San Francisco residents, especially people who are most in need and most at risk from traffic deaths, climate impacts and air pollution. Also, Prop. L represents a continuation of a tax, not a new tax.

Even though the City of San Francisco has challenges completing capital projects on time and on budget, most municipalities in this country face similar problems, and that is not enough of a reason to deny funding. Further, the SFCTA and the San Francisco Municipal Transportation Agency have been proactively and earnestly addressing these challenges for new projects in order to minimize the risk of cost increases and delays for future capital projects.

Most importantly, this funding is needed to maintain and improve transportation services, especially given lower revenues from fares as the pandemic continues. Without this funding, San Franciscans will experience lasting negative impacts to climate, equity, health and the economy. For instance, deferring maintenance means that sidewalks, streets and transit would be allowed to deteriorate, making it harder for the city to function. Without this tax, Muni, BART, Caltrain and other transit operators that would receive funding from Prop. L could be forced to make service cuts, leading to fewer riders and more congested roads.

[1] San Francisco County Transportation Authority, “2022 Transportation Expenditure Plan,” https://www.sfcta.org/ExpenditurePlan (accessed on July 28, 2022).

[2] “Equity priority communities,” as defined by the Metropolitan Transportation Commission, are areas that are considered disadvantaged, with higher percentages of households of color, low-income households, seniors and people with limited English proficiency. See Metropolitan Transportation Commission, “Equity Priority Communities,” https://mtc.ca.gov/planning/transportation/access-equity-mobility/equity-priority-communities (accessed on July 29, 2022).