OAK

Measure

MM

Special District Tax

Oakland Hills Wildfire Prevention Zone Tax

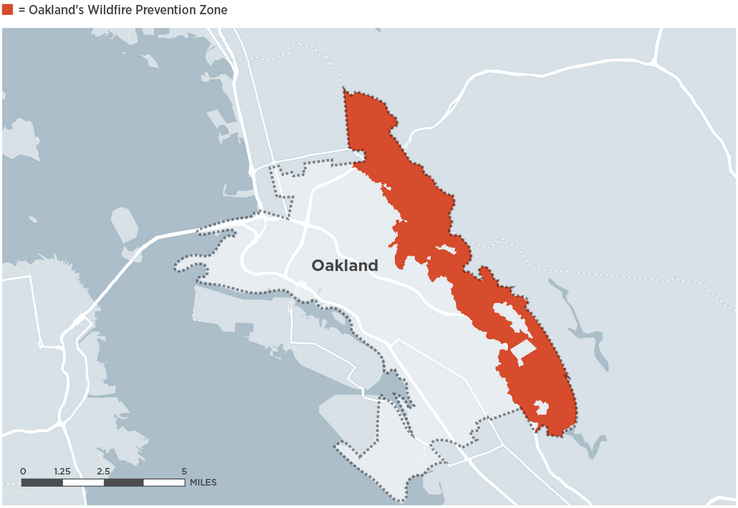

Levies a special district parcel tax on properties in Oakland’s Wildfire Prevention Zone to fund wildfire prevention activities.

Vote YES

Levies a special district parcel tax on properties in Oakland’s Wildfire Prevention Zone to fund wildfire prevention activities.

Measure MM would create a dedicated funding source for the city to address wildfire risk through vegetation management, goat grazing for fuel reduction, enhanced fire patrols, public education, and evacuation route protections. This special tax would be levied on residential and non-residential properties in the Wildfire Prevention Zone, also referred to as Oakland’s Very High Fire Hazard Severity Zone, a designation by Cal Fire.

The measure would fund the implementation of a comprehensive 10-year Vegetation Management Plan, which covers approximately 1,924 acres of city-owned land and 308 miles of roadway in the Wildfire Prevention Zone.1 Measure MM funds would be used for the following activities:

Under the measure, impacted residential property owners would pay $99 per single-family home and $65 per apartment. The tax on non-residential parcels would be determined by frontage and total square footage of the parcel. Annual increases would be based on cost-of-living adjustments and the Consumer Price Index, with a cap of 5%. The tax would begin on July 1, 2025, and sunset in 20 years. This special tax would collect an estimated $2.67 million for wildfire resilience efforts in its first year.2

An oversight committee would receive an independent audit of expenses and an annual report on the activities funded by the tax and would make recommendations directly to Oakland City Council.

The measure was placed on the ballot by the City Council and requires a two-thirds majority of voters in the Wildfire Prevention Zone to pass.

In 1991, a grass fire spread through the East Bay Hills, burning 1,500 acres, taking 25 lives, destroying over 3,500 homes, and causing the evacuation of 10,000 people. The fire resulted in economic losses of about $2.99 billion (in 2023 dollars).3 Actions to prevent future wildfires could be critical to preventing steep future costs like these. The Federal Emergency Management Agency estimates that every $1 invested in mitigation activities saves $6 in future losses from climate and natural disasters.4

By reducing wildfire risk, Measure MM could also be an important step toward easing the home insurance crisis facing many homeowners in the Oakland Hills, as some home insurers have sent non-renewal notices or raised premiums in the area.5

Since the 1991 fire, the City of Oakland has implemented special taxes to fund fire prevention in the impacted districts, but these voter-approved measures have not been funded continuously. In 1992, the city’s first Wildfire Prevention Assessment District (WPAD) was established, and property owners in the district began paying property tax assessments for fire prevention. The assessment district lasted just five years, and from 1997 to 2003, the city only maintained basic wildfire prevention services until voters re-established the WPAD for 10 years in 2003.

Oakland has previously tried to replace the WPAD with a Wildfire Prevention Zone special district tax because this type of tax would enable the city to implement fire prevention measures in a broader area, not just specific to properties. In 2013, voters did not approve a similar measure, likely due to the lack of a comprehensive plan or a coordinated interdepartmental effort to prevent wildfires. In 2019, the Oakland City Council adopted a resolution to prioritize wildfire prevention. In May 2024, the city adopted its first Vegetation Management Plan, a 10-year plan to reduce fuel loads on city-owned properties and along roadways, finally giving residents a strategic plan for wildfire mitigation efforts.6

Current wildfire mitigation activities are funded out of the Oakland General Fund, which puts wildfire management in competition with other city priorities, especially in the face of a nearly $177 million budget shortfall in 2024.7 Amid the budget shortfall and concerns of a repeat of the 1991 fire, the City Council placed the Wildfire Prevention Zone special district measure on the ballot. The measure requires a two-thirds majority support from voters residing within the Special District.

Although the measure would call for a new tax on property owners, there would be exemptions for low-income homeowners making at or below 60% of the area median income (AMI) and seniors making less than 80% of AMI. For rental housing, the tax would be reduced by 50% in developments owned by nonprofit corporations and nonprofit-controlled partnerships for senior, disabled, and low-income households.

Most renters in the Wildfire Prevention Zone would be protected from rent increases by the city’s Rent Adjustment Program, which limits the amount that property owners can increase rents and which prohibits passing the additional cost of the tax to tenants.8

This special tax would remove the burden on the General Fund for wildfire mitigation efforts, so the General Fund could be used for other critical programs that more directly benefit Oakland’s lower-income neighborhoods and residents. In the Oakland Hills, the median household income is greater than $120,000,9 so raising money for fire prevention directly from those property owners rather than from the city at large provides a measure of social equity. Without mitigation efforts, the cost of recovering from a wildfire, including restoring roadways and infrastructure, could substantially reduce the availability of resources for the rest of the city.

Periods of intense rains followed by dry summers and drought conditions have exacerbated wildfire risk in Oakland, especially in the Oakland Hills, where there’s a higher chance of severe fires. Climate change will only worsen this hazard. Prop. MM would fund actions identified in the City of Oakland’s Equitable Climate Action Plan to reduce wildfire risk. It would pay for the tools in the recently adopted 10-year Vegetation Management Plan, including fire patrols, goat grazing for fuel reduction, public education, and evacuation route protections, all of which are critical activities to protect residents and structures from costly wildfire damage and destruction.

1. City of Oakland, “Oakland Vegetation Management Plan,” 2024, https://www.oaklandca.gov/projects/oakland-vegetation-management-plan.

2. Joe DeVries, “Agenda Report: Wildfire Prevention Zone Special Tax,” City of Oakland, 2024, https://oakland.legistar.com/LegislationDetail.aspx?ID=6693996&GUID=D0DA215B-C9A5-4DA1-8829-F17131389E3B&Options=ID%7CText%7C&Search=wildfire+tax.

3. Lawrence M. Fisher, “Oakland Fire a Costly One for Insurers,” The New York Times, October 23, 1991, https://www.nytimes.com/1991/10/23/business/oakland-fire-a-costly-one-for-insurers.html.

4. FEMA, “Natural Hazard Mitigation Saves Interim Report Fact Sheet,” 2018, FEMA, https://www.fema.gov/sites/default/files/2020-07/fema_mitsaves-factsheet_2018.pdf.

5. Natalie Orenstein, “Home Insurance Canceled in Oakland? Here’s What to Do,” The Oaklandside, July 16, 2024, http://oaklandside.org/2024/07/16/insurance-united-policyholders-amy-bach-oakland/.

6. City of Oakland, “Oakland Vegetation Management Plan,” 2024, https://www.oaklandca.gov/projects/oakland-vegetation-management-plan.

7. Eli Wolfe, “Oakland’s Big Budget Crisis: What You Need to Know,” The Oaklandside, June 28, 2004, http://oaklandside.org/2024/06/28/oakland-big-budget-crisis-what-you-need-to-know/.

8. Oakland Tenants Union, “Oakland Rent Adjustment Program,” https://www.oaklandtenantsunion.org/oakland-rent-adjustment-program.html.

9. DataUSA, “Oakland, CA,” https://datausa.io/profile/geo/oakland-ca/#:~:text=In%202022%2C%20the%20place%20with,values%20of%20%24250%2C001%20and%20%24247%2C619.