On April 15, Oaklanders will vote on a proposed measure to raise the city’s sales tax from 10.25% to 10.75%, potentially generating an additional $29.98 million in net annual revenue for the city’s General Fund over 10 years. While Measure A is a regressive tax that will not solve Oakland’s structural deficit on its own, SPUR believes this additional revenue source will help prevent fiscal insolvency and protect against further reductions in public safety services. Vote YES on Measure A.

What Would the Measure Do?

The proposed increase in the Transactions and Use Tax by 0.5% from 10.25% to 10.75% is a measure permitted under state law. If approved by voters on April 15, the measure would amend the City of Oakland’s municipal code to add the 0.5% increase to the sales tax for 10 years. The increase is estimated to generate an additional $29.98 million in net revenue for the city’s General Fund each year.

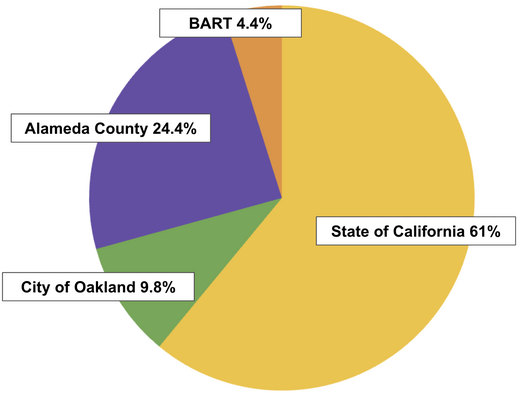

Currently, the City of Oakland receives only 1% of the total current 10.25% sales tax, meaning the city receives 1 cent on each taxable dollar spent in the county; the state, the county, and Bay Area Rapid Transit (BART) receive the rest.

Oakland’s Piece of the Sales Tax Pie Is Small

More than 90% of the sales tax in Oakland goes to the state, the county, and BART.

If the measure passes, it would increase the portion that comes to the City of Oakland to 1.5% and generate an estimated $30.2 million in additional gross tax revenue for the city in the first year, according to the City Auditor’s Office. After subtracting the costs of administering the tax, the city would net approximately $29.98 million in additional revenue after the first year. Costs include a one-time preparatory fee estimated to be $40,000 and an annual administrative fee of approximately $233,000 from the state. Additionally, the city would incur an annual fee of approximately $12,000 to recover the additional revenue due.

The Measure Would Involve Some One-Time and Recurring Administration Costs

The tax would cost about $285,000 to administer, netting nearly $30 million in additional revenue in the first year.

| Estimated additional revenue to be collected | $30,200,000 |

| One-time preparatory cost charged to city | $40,000 |

| Annual charges based on taxes collected | |

| California Department of Tax and Fee Administration annual administration fee | $233,000 |

| Annual consultant cost (to recover additional revenue) | $12,000 |

| Net annual additional revenue in the first year | $29,977,000 |

Why Was the Measure Proposed?

Oakland is facing significant challenges as city leaders work to address a budget shortfall of $129 million this year, with an additional $280 million projected over the next two years. Deeply rooted structural issues underly the city’s fiscal distress, including the economic impacts of the COVID-19 pandemic, the rising cost of pension liabilities and insurance, and an over-reliance on one-time funds to backfill budget gaps.

Now that those one-time funds are no longer available, the city has had to make immediate spending cuts to balance the budget for the 2024–2025 fiscal year. Oakland has eliminated police academies; browned out fire stations; reduced community grants and contracts; instituted a freeze on hiring, travel, and training; and laid off employees. However, according to the city administration, additional revenue streams will also be needed to help close the deficit without making even bigger cuts to essential services.

The Measure Would Raise the Sales Tax From the Lowest to the Highest Rate in the County

The proposed new tax rate would be among the highest in the region, along with six other Alameda County cities: Alameda, Albany, Hayward, Newark, San Leandro, and Union City.

| City | Sales Tax Rate |

| Alameda | 10.75% |

| Albany | 10.75% |

| Berkeley | 10.25% |

| Dublin | 10.25% |

| Emeryville | 10.50% |

| Fremont | 10.25% |

| Hayward | 10.75% |

| Livermore | 10.25% |

| Newark | 10.75% |

| Oakland | 10.25% |

| Piedmont | 10.25% |

| Pleasanton | 10.25% |

| San Leandro | 10.75% |

| Union City | 10.75% |

In November, Oaklanders approved two local tax measures, Measure MM, a special district tax on properties in the Oakland Hills to fund wildfire prevention activities, and Measure NN, which extends and increases a parcel tax and a parking tax surcharge for an additional nine years to fund police, fire, and violence prevention services. However, unlike these two taxes, the proposed measure won’t increase funds for city services. Instead, it will help close the gap to prevent further reductions in services. Without these funds, the city anticipates further reductions to public safety services and community programs.

Two trends help explain why the city has proposed a sales tax increase to ease its fiscal crisis.

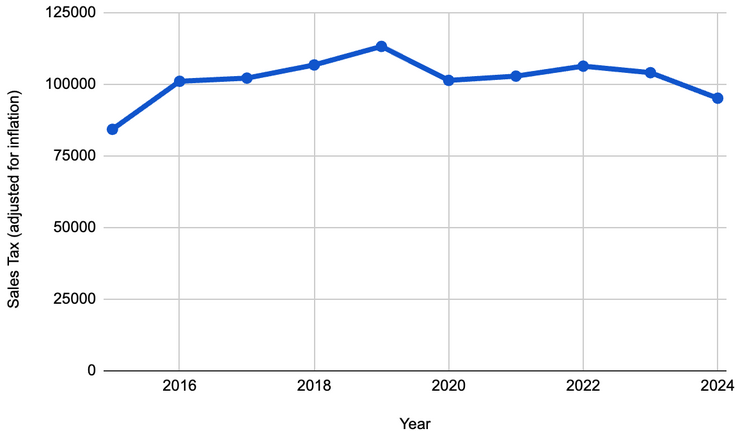

Taxable Sales Are in Decline

California has been seeing a decline in sales tax revenue over the last couple of years. HdL Companies reported a 2.5% decrease in sales tax receipts in the fourth quarter of 2023 compared to the same period in 2022 and a 2.3% decrease year over year. The biggest contributors to the declines are fuel and service stations and auto and transportation sales.

Oakland’s Sales Tax Revenue Began Falling in 2019

The city’s taxable sales are lower now than they were in 2016.

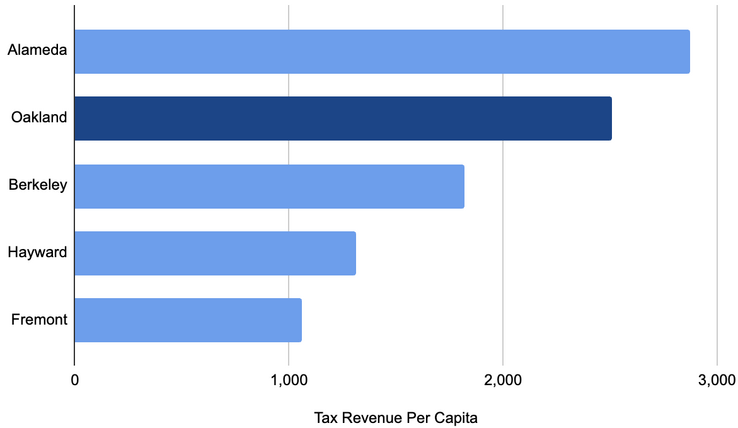

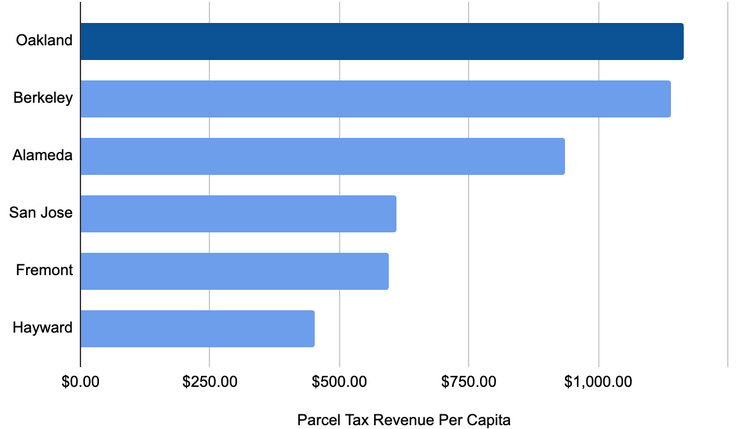

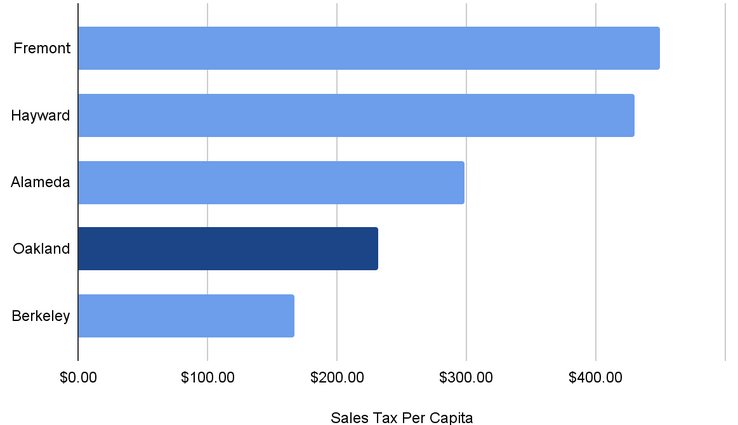

Oakland Collects Less Sales Tax Than Neighboring Cities

Generally, tax revenue per capita in Oakland is higher than most other neighboring jurisdictions in Alameda County and is the highest when it comes to parcel taxes. However, sales tax per capita is lower in Oakland due to its relative lack of large, traditional "big box" retail stores.

Compared to Most Neighboring Jurisdictions, Oakland Has a Lower per Capita Sales Tax

Even though per capita tax revenue and parcel tax revenue are higher in Oakland than in neighboring cities, per capita sales tax is lower due to a relative absence of large retail stores.

Additional Sales Tax Measures May Be on a Future Ballot

Significant work has been underway on potential regional revenue measures in 2026 for housing and transportation. While Oakland’s Measure A would not directly conflict with a future regional funding measure, measures to fund other critical infrastructure and services will likely be placed on a future ballot. These measures could include additional sales tax hikes.

Equity Impacts

Sales taxes are a regressive tool for raising revenue because they levy the same rate on consumers regardless of income. While everyone pays the same tax rate at the register, low-income people end up paying a greater percentage of their income on sales taxes, and this disparity is increased during inflationary periods. In fact, recent SPUR research shows that low-income households in the Bay Area pay more than three times as much in sales taxes (as a percentage of income) than those in the top income quintile.

Yet, even as an increase in the sales tax will put an undue burden on lower-income people, the revenues generated by Measure A could help low-income communities by preserving police and fire services and community programs that benefit them. Many small and disadvantaged businesses in Oakland are struggling due to real and perceived crime, so the city’s capacity to continue offering public safety services will also benefit them.

Pros and Cons

Pros

- The passing of this sales tax would bring in $29.98 million of much-needed revenue and reduce the negative impacts of the current budget deficit, including possible cuts to essential services and fiscal insolvency.

- The money generated from the sales tax will go to Oakland’s general fund, allowing for spending and service flexibility.

- With this increase, the city’s sales tax rate will be in line with many neighboring jurisdictions where Oakland residents frequently go to shop.

- The measure includes a termination date after 10 years.

Cons

- The measure fails to address the regressive nature of the proposed sales tax, offering no provisions to ensure that the burden on low-income individuals and small businesses is mitigated. Without a clear mechanism to direct a significant portion of the revenue toward programs benefiting vulnerable communities, the measure risks exacerbating economic inequality and placing an unfair burden on those who can least afford it.

- Many small businesses in Oakland have been struggling to survive post-pandemic. Raising the sales tax could exacerbate their challenges in Oakland as well as make Oakland less competitive than other places in the region for certain types of businesses.

- The measure would not fully close Oakland’s current $129 million deficit or the projected two-year deficit of $280 million. Oakland will still need to pursue additional funding strategies and reductions in services to close the gap.

- The 2026 ballot could include an increased sales tax measure, given significant work underway on potential regional revenue measures for housing and transportation.

SPUR’s Recommendation

Oakland is facing a major budget deficit in part because of the city’s inability to adhere to sound financial management practices over the last few years, which have compounded the issue. However, the city has begun making significant cuts to expenses. Measure A will help address the structural deficit by bringing in ongoing, predictable revenues and by reducing the negative impacts of the current budget deficit. While this measure is a regressive tax that will not solve Oakland’s structural deficit, SPUR believes the proposed increase is a needed revenue source to prevent fiscal insolvency and protect against further reductions in public safety services. Whatever the fate of Measure A, SPUR urges the city to take stronger financial accountability measures to regain the public’s trust that tax dollars will be spent prudently. Furthermore, Oakland needs to develop a long-term economic development and revenue generation strategy to grow its tax base and to do so in conjunction with permanent structural expenditure reductions.